Disaster preparedness and home insurance

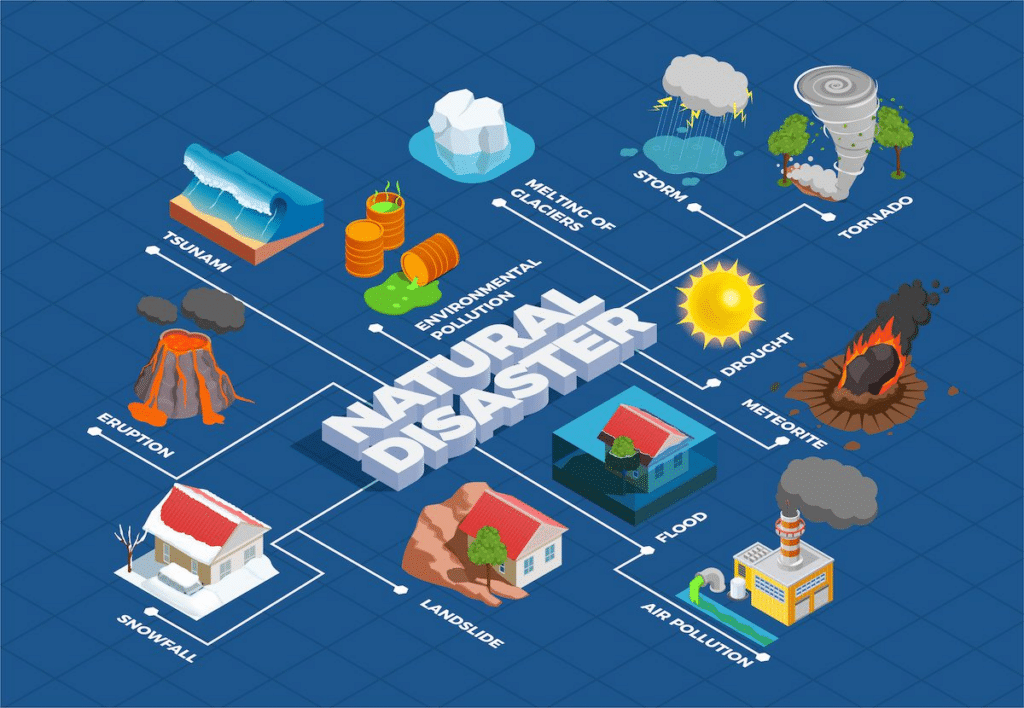

Ensuring the safety of your home and the well-being of your family in the face of calamities is a subject that cannot be overstressed. As the world witnesses an upsurge in natural and man-made disasters, awareness and preparedness have never been more crucial. This blog post delves into the significance of disaster preparedness insurance and how it interlinks with home insurance, offering peace of mind and financial security.

From understanding policies to drafting a disaster readiness plan, we break down what homeowners need to know to safeguard their investments and loved ones against unexpected catastrophes.

Understanding Your Home Insurance Policy

Before diving into the intricacies of disaster preparedness insurance, one must comprehend the coverage provided by a standard home insurance policy. While many assume that their home insurance gives them a blanket coverage against all perils, this is often not the case. Natural disasters like floods, earthquakes, and hurricanes may require additional riders or separate policies altogether.

It's essential to review your policy annually and understand the exclusions and limitations. Speak with your insurance provider to ensure that your coverage aligns with the potential risks specific to your location. This proactive approach will spare you from unpleasant surprises when you need to file a claim.

The role of disaster preparedness insurance comes into play by filling these coverage gaps. Semantically linked to your home insurance, it's designed to provide extra layers of protection against particular threats that are not typically covered in a basic home policy.

Disaster Readiness Plan

Having a disaster preparedness plan is the cornerstone of ensuring safety during unforeseen events. This involves creating an emergency kit, drafting an evacuation plan, and staying informed about the local disaster response protocols. Integrating insurance into this plan means keeping an inventory of your possessions and the necessary insurance documents handy in case of evacuation.

Insurance shouldn't only be reactive; it is also a proactive instrument in disaster readiness. By incorporating disaster preparedness insurance into your plan, you are taking a significant step towards mitigating financial losses that can occur.

Preventive Measures and Risk Reduction

Disaster preparedness does not solely hinge on having the right insurance—it also involves taking physical measures to protect your property. Simple actions such as securing heavy furniture, retrofitting your home to withstand earthquakes, or installing flood barriers can significantly reduce the risk of damage.

Insurers often reward proactive homeowners with lower premiums or discounts. By demonstrating that you have taken steps to diminish the risks associated with disasters, you prove to insurance companies that you are a lower-risk client.

Choosing the Right Disaster Preparedness Insurance

When selecting disaster preparedness insurance, assess all available options. Different providers offer varying levels of coverage, deductibles, and premiums. Carefully evaluating what disasters your area is prone to is the first step in determining what additional coverage you may need.

Consider the reputation of the insurer, their claim settlement history, and the comprehensiveness of their policies. Remember that the cheapest option might not always be the best when it comes to insurance.

Financial Stability Post-Disaster

Disaster preparedness insurance acts as a financial safety net, helping you to rebuild and recover in the aftermath. It can cover the cost of repairs, temporary housing, and even counseling services. The absence of adequate coverage could lead to catastrophic financial consequences that could burden you for years to come.

Working Together with Insurers for Greater Resilience

Developing a relationship with your insurer is beneficial. They can provide valuable insights into risks and offer guidance on how to protect your home better. This collaboration can result in more excellent preparedness and ensure that, should a disaster strike, the recovery process is as smooth as possible.

Environmental Changes and Policy Adaptation

Insurance policies should evolve congruently with the changing environmental landscape. As climate change prompts more frequent and severe weather events, insurers and policyholders alike must adapt. Periodic policy reviews to accommodate these changes are necessary to maintain adequate coverage levels.

Key Considerations for Long-Term Security

In summary, your quest for long-term security involves not only purchasing disaster preparedness insurance but also engaging in continuous education about disaster mitigation and preparedness. Beyond the insurance scope, consider community resources and government initiatives that provide support for disaster resilience.

The Role of Technology in Disaster Preparedness

Utilize technology to your advantage. Mobile apps, alerts, and online resources can complement your disaster preparedness insurance, keeping you updated with real-time information during emergencies. These tools can make all the difference when every second counts.

Final Thoughts on Ensuring Adequate Coverage

Your home is likely one of your most significant investments, and the welfare of your family is invaluable. Taking the time to ensure your disaster preparedness insurance complements your home insurance can save you from irreplaceable losses and give you the security you deserve.

In conclusion, the synergy between disaster preparedness and home insurance is undeniable. With the right strategies and an understanding of disaster preparedness insurance, you position yourself to stand resilient against the unpredictable. Awareness, preparation, and a comprehensive insurance plan are your best defenses against the caprices of nature and other calamities.

Related